Collision Comprehensive Insurance: Protection for Your Vehicle and Pocket

Introduction

Car accidents are just a part of life, and if you are a driver, it’s an unfortunate reality that you might face one at some point in your life. Even if it wasn’t your fault, the damage done to your vehicle can still be costly. This is where collision comprehensive insurance comes in to protect your investment. In this article, we will discuss everything you need to know about collision comprehensive insurance, its benefits, and how it works.

What is Collision Comprehensive Insurance?

Collision comprehensive insurance is a type of car insurance that covers damages to your vehicle when you collide with another object or vehicle. It doesn’t matter if you are at fault or not; your insurance policy will cover the cost of repairing or replacing your car up to the limit specified in the policy.

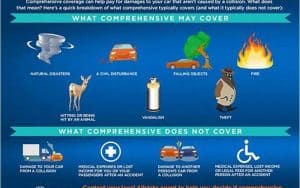

Comprehensive insurance, on the other hand, covers damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters like floods or earthquakes. In this article, we will focus on collision coverage only.

What Does Collision Comprehensive Insurance Cover?

Collision comprehensive insurance covers damages to your vehicle when you collide with:

- Another vehicle

- A stationary object like a tree, pole, or building

- A pothole or animal on the road

- Any other obstacle that causes damage to your car

It’s important to note that collision comprehensive insurance doesn’t cover medical expenses or damages to property belonging to others. For that, you need liability insurance.

How Does Collision Comprehensive Insurance Work?

When you purchase collision comprehensive insurance, you agree to pay a premium to your insurance provider. In exchange, the provider promises to pay for damages to your vehicle if you’re involved in an accident.

If you get into an accident and your car is damaged, you will need to file a claim with your insurance provider. The provider will send an adjuster to evaluate the damage and determine the cost of repairs or replacement.

If the cost of repairing the car is less than the car’s value, the insurance provider will pay for the repairs. If the cost of repairs is more than the car’s value, the provider may choose to declare the car a total loss and pay you the car’s actual cash value minus your deductible.

It’s important to read and understand the terms and conditions of your policy before signing up. Make sure to note the deductible amount that you’ll have to pay in case of a claim. A deductible is the amount that you need to pay out of your pocket before your insurance provider starts covering the rest of the costs.

The Benefits of Collision Comprehensive Insurance

1. Peace of Mind

Knowing that you have collision comprehensive insurance can give you peace of mind, especially if you own an expensive car. You can drive without worrying about what would happen if you get into an accident because you know that your insurance policy will cover the damages.

2. Protection for Your Investment

Your car is probably one of the biggest investments you’ve made. Collision comprehensive insurance ensures that you don’t lose money on your investment if it gets damaged in an accident. You’ll be able to recover the cost of repairs or get a replacement vehicle if your car gets totaled.

3. Minimal Out-of-Pocket Expenses

Collision comprehensive insurance helps minimize out-of-pocket expenses. If you get into an accident, you only need to pay your policy’s deductible. Your insurance provider will cover the rest of the cost of damage. This can be especially helpful if the damage is extensive.

4. Coverage for Any Type of Collision

Collision comprehensive insurance covers any type of collision damage, regardless of who is at fault. It doesn’t matter if you hit another car, a tree, or a pothole; your policy will cover the repair or replacement cost.

5. Flexibility in Choosing the Right Coverage

Collision comprehensive insurance policies come in different levels of coverage. You can choose a policy that fits your budget and coverage needs. If you drive an old car that’s worth very little, you might opt for a basic policy. If you have a new car or an expensive car, you may want to get comprehensive coverage.

6. Legal Requirement

In some states, collision comprehensive insurance is a legal requirement. If you live in one of these states, you must have this type of coverage to drive legally. Even if it’s not a requirement, it’s still a good idea to have this type of insurance to protect your investment.

The Cost of Collision Comprehensive Insurance

The cost of collision comprehensive insurance varies depending on several factors, including:

- Your driving record

- Your car’s make and model

- Your age and demographics

- Your location

- The level of coverage you choose

If you have a good driving record, you’ll pay less for collision comprehensive insurance because you’re considered a low-risk driver. The type of car you drive also affects the cost of your policy. Expensive cars cost more to insure because they’re more expensive to repair or replace.

Your age and location also play a role in determining your insurance premium. Younger drivers and those who live in areas with high crime rates or adverse weather conditions may pay more for collision comprehensive insurance.

When choosing a policy, make sure to shop around and compare prices from different insurance providers. You might also want to consider bundling your collision comprehensive insurance with other types of insurance to save money on premiums.

FAQs About Collision Comprehensive Insurance

1. Do I Need Collision Comprehensive Insurance if I Have Liability Insurance?

Liability insurance only covers damages and injuries to others if you’re at fault in an accident. It doesn’t cover your own vehicle. If you want to protect your investment and ensure that you’re covered in case of an accident, you’ll need to get collision comprehensive insurance.

2. What’s the Difference Between Collision Comprehensive Insurance and Liability Insurance?

Collision comprehensive insurance covers damages to your own vehicle, regardless of who is at fault. Liability insurance, on the other hand, only covers damages and injuries to others if you’re at fault in an accident.

3. How Do I File a Claim for Collision Comprehensive Insurance?

If you’re involved in an accident and need to file a claim, contact your insurance provider as soon as possible. They will assign an adjuster to evaluate the damages and determine the cost of repairs or replacement. You’ll need to provide them with details about the accident, including the location, date, and time, and any other information they need to process your claim.

4. What Happens if I Don’t Have Collision Comprehensive Insurance?

If you don’t have collision comprehensive insurance and get into an accident, you’ll have to pay for the repairs or replacement of your vehicle out of pocket. This can be costly, especially if the damage is extensive.

5. What Factors Affect the Cost of Collision Comprehensive Insurance?

The cost of collision comprehensive insurance depends on several factors, including your driving record, the type of car you drive, your age and location, and the level of coverage you choose.

6. What Does a Deductible Mean?

A deductible is the amount of money that you need to pay out of your pocket before your insurance provider starts covering the rest of the costs. For example, if your deductible is $500 and the cost of repairs is $5,000, you’ll need to pay $500, and your insurance provider will pay the remaining $4,500.

7. Can I Lower My Premiums?

Yes, you can lower your premiums by choosing a higher deductible or bundling your collision comprehensive insurance with other types of insurance.

Conclusion

Collision comprehensive insurance is an essential type of car insurance that can help protect your investment and give you peace of mind when driving. It covers damages to your own vehicle, regardless of who is at fault and can minimize out-of-pocket expenses in case of an accident. When choosing a policy, make sure to read and understand the terms and conditions, shop around for the best price, and choose a level of coverage that meets your budget and needs. By doing so, you’ll be able to drive confidently, knowing that you’re covered in case of an accident.