Everything You Need to Know About SR22 Insurance in TX

Introduction

Are you a Texas driver who has recently had their license suspended or revoked? If so, you may need to obtain SR22 insurance in order to get back on the road legally. SR22 insurance is a special type of insurance policy required by the state of Texas for drivers who have been deemed high-risk. It provides proof of financial responsibility and may help you regain your driving privileges. In this article, we’ll explore everything you need to know about SR22 insurance in TX, including what it is, who needs it, and how to obtain it.

Sr22 insurance tx: What is it?

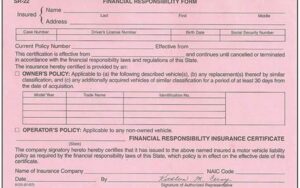

SR22 insurance is not a type of insurance policy, but rather a certificate that proves a driver has liability insurance that meets the state’s minimum coverage requirements. It’s also known as a Certificate of Financial Responsibility (CFR) or a Certificate of Insurance. The certificate is filed with the Texas Department of Public Safety (DPS) by an insurance company on behalf of the driver. It’s required for drivers who have had their license suspended or revoked due to certain offenses, such as driving under the influence (DUI) or driving without insurance.

How does sr22 insurance tx work?

When a driver is required to obtain SR22 insurance, their insurance company will file the certificate with the Texas DPS. This serves as proof that the driver has the required amount of liability insurance coverage. The insurance company is required to notify the DPS if the driver’s policy is canceled or lapses for any reason. If this happens, the driver’s license may be suspended again until they obtain a new SR22 certificate.

What are the coverage requirements for sr22 insurance tx?

In Texas, the minimum liability insurance coverage required for SR22 insurance is 30/60/25. This means the policy must provide at least:- $30,000 in bodily injury coverage per person – $60,000 in bodily injury coverage per accident – $25,000 in property damage coverage per accident It’s important to note that these are only the minimum requirements and may not provide enough coverage in the event of a serious accident. Drivers who have been required to obtain SR22 insurance may want to consider purchasing additional coverage to protect themselves financially.

Who needs sr22 insurance tx?

Not all drivers in Texas are required to obtain SR22 insurance. It’s typically only required for drivers who have been deemed high-risk due to certain offenses, such as:- DUI or DWI – Driving without insurance – Driving with a suspended or revoked license – Repeat traffic offenses If you’re unsure whether you need SR22 insurance, you should contact the Texas DPS or a licensed insurance agent for guidance.

How do I obtain sr22 insurance tx?

To obtain SR22 insurance in Texas, you’ll need to contact an insurance company that offers this type of coverage. Not all insurance companies offer SR22 insurance, so you may need to shop around to find one that does. Once you’ve found a company, you’ll need to purchase a liability insurance policy that meets the state’s minimum coverage requirements.The insurance company will then file an SR22 certificate with the Texas DPS on your behalf. You’ll need to pay a processing fee, which varies by insurance company. The fee for filing an SR22 certificate is typically between $15 and $50.

How long do I need to have sr22 insurance tx?

The length of time you’ll need to have SR22 insurance in Texas depends on the reason why you were required to obtain it. In most cases, you’ll need to have the certificate filed for two years from the date of your license suspension or revocation. However, if you’re required to maintain an SR22 certificate for a longer period of time, the Texas DPS will notify you.

What happens if I let my sr22 insurance tx lapse?

If your SR22 insurance policy is canceled or lapses for any reason, your insurance company is required to notify the Texas DPS. If this happens, your license may be suspended again until you obtain a new SR22 certificate. It’s important to make sure your policy is up to date and that you make all of your payments on time to avoid any lapses in coverage.

How much does sr22 insurance tx cost?

The cost of SR22 insurance in Texas varies depending on several factors, including your driving record and the coverage amount you choose. In addition to the cost of the insurance policy, you’ll also need to pay a processing fee to have the SR22 certificate filed with the DPS. This fee is typically between $15 and $50.

Sr22 insurance tx: Frequently Asked Questions

1. Can I cancel my sr22 insurance tx once I no longer need it?

Yes, once you’re no longer required to maintain an SR22 certificate, you can cancel your policy. However, it’s important to make sure you have another form of insurance in place before canceling, as driving without insurance in Texas is illegal.

2. Will my sr22 insurance tx raise my rates?

Yes, SR22 insurance is typically more expensive than a standard insurance policy. This is because drivers who require SR22 insurance are considered high-risk and therefore more expensive to insure. However, shopping around and comparing rates from different insurance companies can help you find the most affordable option.

3. Does my sr22 insurance tx cover me in other states?

Yes, your SR22 insurance policy will provide coverage in any state that you’re legally allowed to drive in. However, it’s important to make sure your policy meets the minimum coverage requirements for the state you’re driving in.

4. Can I drive a rental car with sr22 insurance tx?

Yes, as long as you have a valid driver’s license and your SR22 certificate is in good standing, you can drive a rental car. However, you should check with the rental car company to make sure they allow drivers with SR22 insurance.

5. What happens if I’m involved in an accident while I have sr22 insurance tx?

If you’re involved in an accident while you have SR22 insurance, your insurance policy will provide coverage up to the limits of your policy. However, if the damages exceed your coverage limits, you may be personally liable for the remaining amount.

6. Can I switch insurance companies while I have sr22 insurance tx?

Yes, you can switch insurance companies at any time while you have SR22 insurance. However, you’ll need to make sure your new policy meets the minimum coverage requirements and that your new insurance company is willing to file an SR22 certificate with the Texas DPS.

7. Can I get sr22 insurance tx if I don’t own a car?

Yes, you can still obtain SR22 insurance in Texas even if you don’t own a car. You can purchase a non-owner insurance policy that provides liability coverage for any vehicle you drive.

Conclusion

If you’re a high-risk driver in Texas, SR22 insurance may be a requirement for regaining your driving privileges. It’s important to understand what SR22 insurance is, who needs it, and how to obtain it. The cost of SR22 insurance can be higher than a standard insurance policy, but comparing rates from multiple insurance companies can help you find the most affordable option. Remember to keep your policy up to date and make all of your payments on time to avoid any lapses in coverage. If you have any further questions about SR22 insurance in TX, contact the Texas DPS or a licensed insurance agent.